There’s an art to navigating price comparison sites. Almost the modern-day equivalent of bartering, there are methods of saving a few quid when it comes to picking a broadband provider or renewing your car insurance.

For the latter, adding named drivers or even having a dashcam can fluctuate the price. But job title – something that can’t be altered as easily as removing your gran from the insurance certificate – is another variable that can swing the premiums considerably.

Following our 2020 rundown of the most popular jobs and their associated insurance costs, we’ve looked at the latest figures by occupation, industry and gender.

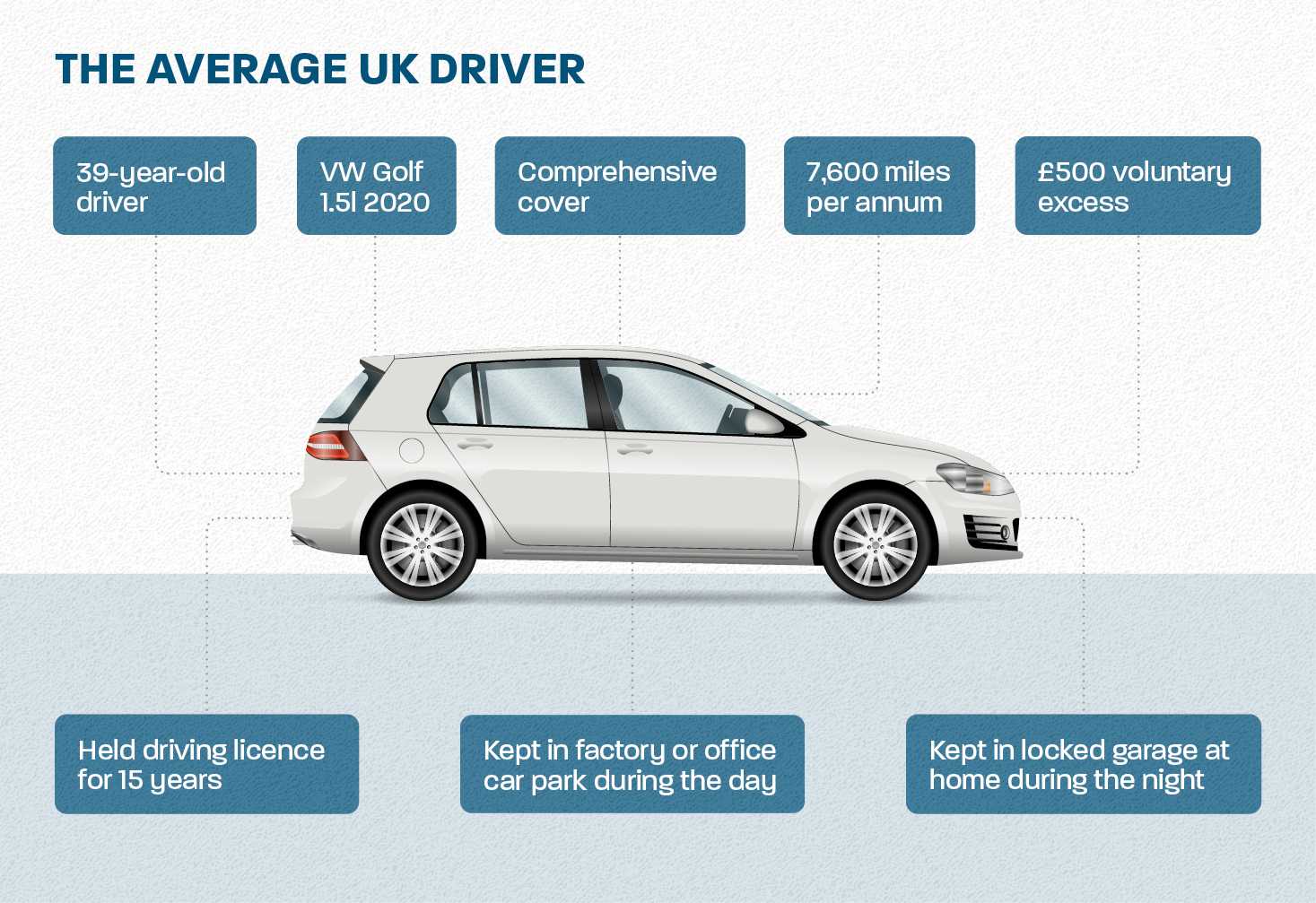

Determining the average driver

To give us the best insight into how job titles and their insurance premiums have changed in the last year, we stuck to the same driver criteria as much as possible. The only variable that changed was the age of the average driver and their car – each a year older.

By inputting the same driver profile – date of birth, miles per annum, date licence was obtained etc. – on the price comparison site, we can be confident that changes in price are almost entirely down to occupation and the insurers’ algorithms they’re put into.

Recruitment Consultants, look away now.

Recruitment Consultants pay £800+ for their car insurance

From our research, the worst job title for insurance costs is now Recruitment Consultant. Since last year, the premium has more than doubled from nearly £350 to over £815, taking it from 30th to 1st on our survey.

In terms of rank, however, it’s Designers who’ve suffered the harshest hike in costs. Despite having the third-most affordable premiums in last year’s results, our 2021 update sees them slide all the way to second with a charge of almost £780 a year.

On the other hand, those with ‘Developer’ in their titles experienced a more favourable change – Software and Web Developers dropped from the 13th- and 15th-most expensive last year to within the cheapest 6% this time around.

Health workers pay more than those in any other sector

Health workers get the worst deal, as the only sector with an average figure in excess of £500 a year. That said, those in the cheapest sector (public admin, defence and social security) are only around £110 better off each year – around £9 per month.

In terms of added costs since 2020, only a handful of the sectors escaped a £100+ price increase this time around. Compared with last year, health workers are charged nearly £160 more for 2021 insurance.

A tough one to take, considering the huge reliance on our health workers over the past year and a bit.

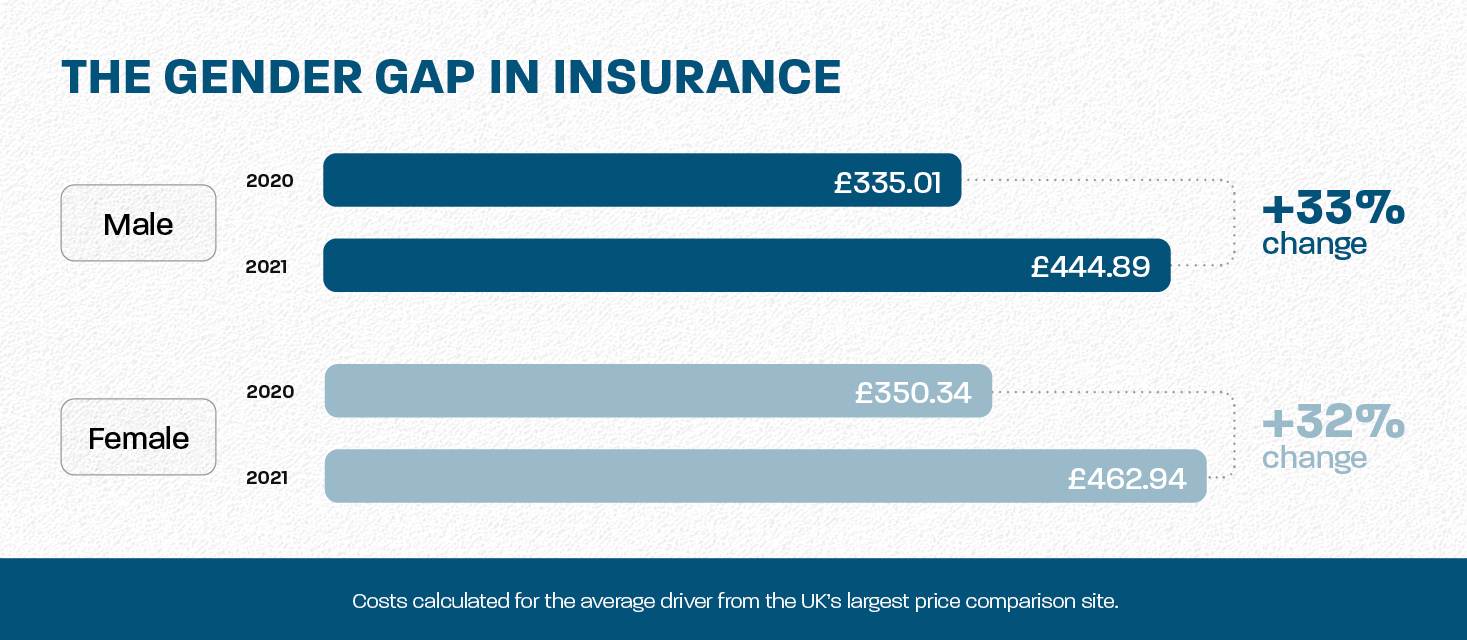

Female drivers still charged nearly £20 more per year

Despite edging it on percentage change since 2020 (32% to 33%), female drivers are still charged almost £20 more per year than males. In fact, that gap has widened since our last research, from just over £15 to £18.

Our ongoing analysis of insurance costs will tell if this is a lasting trend or just an anomaly.

If you’re facing higher insurance premiums, small changes to your driver details can help. Consider adding or removing named drivers and gauge the effect this has on the cost, and make sure you aren’t overestimating your yearly mileage too much. Also, it can be tricky to find an exact occupation match on the comparison sites – try inputting alternatives that still match your role but offer cheaper premiums.

For the latest automotive news and features such as this, make sure to bookmark the Vanarama blog, or head to our car leasing for the latest leasing deals on brand new motors.